FX INSIGHTS

Complacency Killed Corporate Currency Risk Management

Geopolitical events and the central bank hangover have increased uncertainty in just about every world market, especially in the foreign exchange market. Uncertainty over Brexit, US China trade tensions, and the reflation attempts by global central banks are just a few of the recent market events, reminding those doing business abroad of the importance of hedging forex risk. As this unpredictable year continues, companies managing foreign currency risks should review their hedging practices, to prevent an adverse impact to their organization.

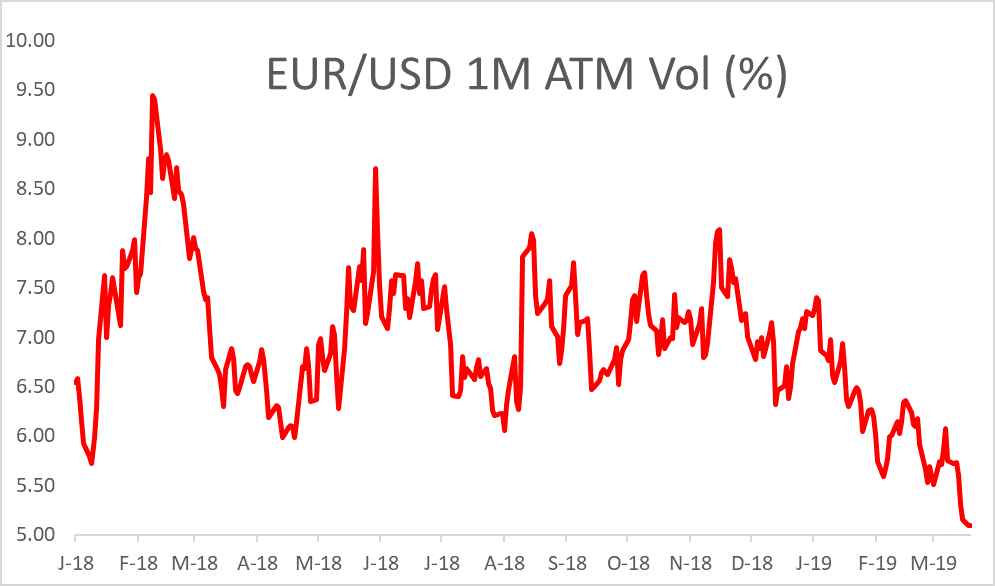

Escalating market uncertainties have driven, some corporations to the sidelines when making currency hedging decisions. The Euro has been confined since November 2018 to its tightest range since inception. FX majors are witnessing extremely low implied option volatility, and analysts who were projecting a return to a weaker US Dollar, have seen it hold firm. It is oxymoronic that the high levels of uncertainty have been met with extremely low volatility, perhaps this is why some companies have held back on implementing fx hedging programs. As sure as we can be on death and taxes, we can be certain that an exogenous shock will liven the currency markets, and expose those who swim naked when the tide goes out. The concern is not if the company should implement a fx policy, but moreover if it should continue hedging if the market is not moving significantly. Should it be reviewing its approach and incorporating more advanced fx analytics for decision making. More importantly does it have the resources in house to do this effectively?

Explaining the Advantages of FX Risk Management to the Company’s Board and Senior Executives

It is not uncommon to find resistance to hedging currency risk from shareholders. Arguments like in the long-run it will all net out and nobody can guess the market direction, completely miss the point of protecting the business and the shareholder investments. As noted, the current nervous malaise in currency markets, is leading to an unhealthy amount of complacency in either building or maintaining a currency hedging program. Once the markets begin moving, and they inevitably will, the level of complacency is likely to be met with the same level of procrastination. When a company is adversely hit from a currency-related event it can create a loss in sales, an increase in cost of goods sold, and a decrease in gross profit. Repeated losses, are rarely the fault of a hedging program, but more likely the result of erratic decision making. For companies working with well thought out hedging programs, fast and erratic markets have a limited, and or delayed, impact on fx performance, benefitting from good planning and smoothed fx outcomes. By presenting risk management policies as a way to gain more control over variables affecting the company’s bottom line, a manager could effectively highlight the advantages of implementing a program to senior executives.

Evaluation and Quantification of a Company’s Currency Exposure

The first step in establishing a ‘fit for purpose’ foreign exchange risk management program consists of evaluating and quantifying the company’s currency exposure. This does not have to be subjective, or qualitative assessment. Computing power and modelling tools have been developed that help quantify an organization’s currency exposure more clearly to determine the potential impact on a company’s profitability. This allows for a better-informed cost analysis to be completed and can bring immediate benefits, such as lower costs, and reduced workflow risk exposure.

As an example these modelling techniques include Value at Risk (VaR) calculations. Historically useful in building maximum loss scenarios, but more effective in day to day operations to build ‘efficient hedging frontiers’ and directing fx managers to diversification benefits in multi-fx exposure scenarios, to significantly reduce hedging costs. It’s hard to argue against a process that allows a company to manage foreign exchange risk for the lowest possible cost, and the highest potential economic return.

Cost Efficiency and Possible Returns on Currency Risk Strategies

Comprehensive currency risk management programs have proven themselves to be extremely cost effective. The implementation benefits of these risk management programs generally far outweigh their cost, with some companies stating that they simply cannot afford to operate without them. Factors to consider before investing in FX risk management include the time and resources required for the implementation and management of the program. Other FX risk management investment factors include:

- Improved Operational Efficiency: implementing modern risk management solutions reduce time spent on FX management and increase their overall efficiency.

- Lower Transaction Costs: eliminate exposures, improve hedge tenures and establish natural hedges, results in lower hedging costs.

- Better Risk Management: Corporate treasurers implementing good programs improve their fx outcomes, stay within prescribed risk thresholds and bring peace of mind to shareholders.

Benefits of Managed Currency Risk Management Programs

Implementation of a ‘fit for purpose’ currency risk management program run by an experienced team, can begin producing results immediately. However, the initial in-depth work required can be out of the scope of a standard corporate finance or treasury team. Independent expertise is available, like those found at Klarity FX, and can help get the process moving in a cost-effective manner. Experts take control of the most burdensome steps of creating and managing a foreign exchange risk management program. Unless significant internal resources are available, additional benefits include access to sophisticated modeling packages, comprehensive market information such as implied fx volatilities, interest rates, correlations, all useful in price negotiations with fx counterparties. The end results are increased financial strength and certainty.

Concluding Thoughts on Corporate FX Risk Management

Given the increased uncertainty that has become the “new normal” in the foreign exchange market, it is prudent for treasuries not to become complacent and to begin implementing corporate currency risk management programs. Not only is this a timely upgrade for any company, but it will impact their future competitiveness.