FX Risk Strategy 2025 : A Practical Guide for CFOs and Treasurers to Reduce Uncertainty

By Amarjit Sahota, Director

June 6th, 2025

4 MIN READ

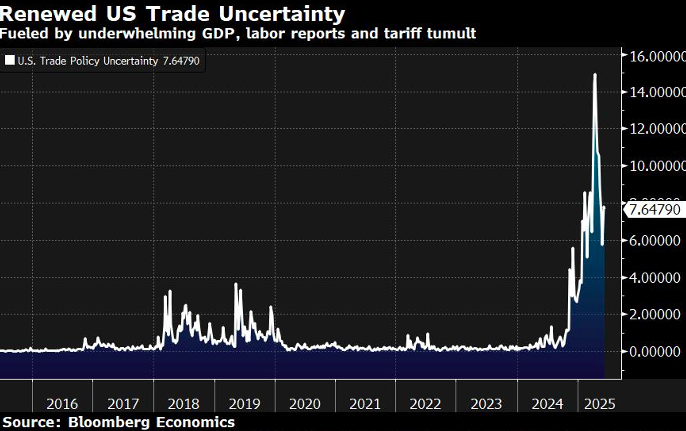

The first half of 2025 has reminded global finance leaders just how quickly currency markets can disrupt forecasts placing emphasis on a robust FX risk management strategy. Diverging interest rate paths, geopolitical tensions in Eastern Europe, the Middle East, and the South China Sea, and a wave of corporate reshoring amid U.S. policy uncertainty have pushed currency strategy back to the top of the CFO agenda.

Despite this, many companies still manage foreign exchange exposure without a clear framework. Some under-hedge. Others take tactical positions without alignment to business needs. Few approach hedging with the discipline of a well-defined, rules-based strategy.

This guide outlines practical, actionable steps CFOs, Treasurers, and Controllers can take to:

- Strengthen their FX risk management framework

- Improve internal coordination and communication

- Make more confident decisions when volatility hits pricing, margins, or cash flow

Revisit your FX Policy: Simplicity, Clarity, and Frequency Win

An FX policy shouldn’t be a document that gathers dust or only resurfaces after a loss. In today’s volatile environment—where EUR/USD can swing 3–4% in a single month and EM currencies face elevated risk—your policy must be both practical and current.

A strong FX policy does three things:

- Protects the business from avoidable financial shocks

- Prevents speculative behavior when emotions run high

- Promotes consistent decision-making across teams and timeframes

In 2025, leading firms are moving toward flexible but rules-based policies that reflect actual business dynamics, not just accounting calendars. A modern FX policy should:

- Be tied to forecast visibility and commercial exposure—not just accounting periods

- FX programs should be reviewed quarterly, not annually

- Be developed and maintained by a cross-functional team including Finance, Treasury, Procurement, and Sales

This cross-functional alignment helps ensure the policy adapts to shifts in pricing terms, supply chains, and currency exposures—before markets force a reaction

Know Your Hedge Objective: Budget Certainty or Cash Flow Control?

One of the most common mistakes in FX risk management is confusing why you're hedging with how you're hedging. In 2025, when market swings are amplified by policy and trade uncertainty, knowing your objective is essential.

There are two core hedging goals:

- Budget Certainty – locking in exchange rates to protect margins and ensure pricing stability

- Cash Flow Control – managing short- to medium-term currency exposures that affect operational liquidity

Misaligning your fx risk management strategy with your business model can create risk instead of reducing it. Avoid these common pitfalls:

- Hedging all exposures uniformly—without considering pricing or contractual terms

- Taking short-term currency views on long-term project revenues

- Over-hedging or under-hedging due to lack of clarity on exposure timing or size

To align your hedge strategy, anchor it to:

- Payment cycles (e.g., monthly vendor settlements)

- Contract durations (e.g., fixed-price customer agreements)

- Supplier and customer currency demands (e.g., shifts from USD to local invoicing)

Make the objective explicit—are you defending a margin, protecting liquidity, or reducing volatility in earnings? The answer will determine the right tools, time horizons, and level of flexibility in your FX program

Know Where the Risk Lives: Map the Real Exposure

An FX risk management strategy is only as effective as its understanding of true economic exposure. In 2025, evolving contract terms, compressed payment windows, and the growth of digital sales have changed how—and where—currency risk shows up.

Don’t let your hedge strategy follow the accounting. Instead, map exposures based on where financial risk actually resides in your business.

Ask these key questions:

- Is this exposure natural or contractual?

- Who owns the margin risk—your company or the vendor?

- How often is pricing reviewed or updated in local currency?

FX advice disconnected from these questions adds cost, not protection. Real value comes from identifying where currency risk threatens pricing, margin, or cash flow—and responding proactively.

Run Scenarios and Stress Test: Not just for the Boardroom

In a volatile FX environment, scenario planning shouldn't be a one-time boardroom exercise—it should be a monthly operational discipline. CFOs and Treasurers need to simulate real risks so that the business can react with confidence, not confusion.

Scenario testing helps answer questions like:

- What happens to Q3 earnings if the USD strengthens 4% vs. the euro?

- How will gross margins in Mexico respond if the peso rallies 6% in two weeks?

- Are we prepared if our Asia-Pacific suppliers switch from USD to local invoicing?

Use scenarios to measure potential shocks to pricing, margin, and liquidity—and to pre-define what actions to take.

Recommended tools in 2025:

- Cash Flow at Risk (CFaR) models by region or business unit

- Variance-based tolerance bands to guide FX hedging decisions

- Buffer ranges or internal FX reserves for long-duration contracts

Scenario planning also enables more effective communication across Finance, Treasury, and Business Units. When external events hit—rate shocks, trade tariffs, political moves—companies with tested FX response playbooks will outperform

Execute with Discipline: Prepare to Hedge - With or Without a Market View

When currency markets move fast, firms without an execution plan fall behind. Whether you have a strong market view or none at all, the key to effective FX risk management strategy is preparedness, not prediction.

Mid-sized and global firms alike often stumble at the execution stage—delaying action, scrambling for approvals, or missing market windows. In 2025, high-volatility conditions demand a proactive stance.

To strengthen execution:

- Set pre-approved thresholds for initiating trades or coverage

- Define roles and responsibilities between Treasury, Finance, and Procurement

- Use order templates for common hedge tenors and instruments

Your FX execution plan should also address supplier agreements:

- Align vendor-side FX clauses with your hedging policy

- Standardize how currency risk is priced, passed through, or shared

And if you rely on external FX partners, ensure they do more than just price trades. Your advisor should understand your business model, exposure profile, and contract flows—so you’re not re-explaining strategy at every market turn.

When volatility spikes, clarity beats speed. Process builds trust, reduces errors, and ensures consistency—especially under pressure.

Conclusion: Build an FX Strategy that Withstands FX Volatility

The companies managing FX risk most effectively in 2025 aren’t the ones predicting every currency move—they’re the ones that operate with discipline, clarity, and alignment across teams.

They know:

- Why they hedge: to protect pricing, margins, or cash flow

- How much they hedge: based on exposures, not emotions

- What they’re solving for: operational resilience, not market wins

An effective FX risk strategy doesn’t depend on being right—it depends on being ready. That means having an updated FX policy, clearly defined hedge objectives, accurate exposure mapping, scenario-tested assumptions, and a streamlined execution plan.

If your organization still approaches FX as a reactive task—or worse, a speculative one—it’s time to build a framework that reflects your actual business needs. Minimize uncertainty. Align your teams. And build a currency risk management process that doesn’t unravel when markets do.