Cost of FX Hedging

By Matt Dawydiak

Feb 18, 2021

Hedging costs have been largely viewed by Multinational corporations, as ‘too expensive’ or ‘complex’. Management prefers to control their exposures largely through spot transactions or through passive forward contract management. Upon further understanding of these costs, in our experience, corporates have considered implementing or actively reviewing a robust fx hedging strategy. Hedging strategy implementation solidifies a strong foundation for an fx program. This will ensure forecastable hedging costs helping achieve financial flexibility across the organization, and confidence from stakeholders, internal and external, within routine business operations.

During the liquidity crunch in March, treasury teams saw how volatile market events can impact their company’s cost of hedging. In the same manner collateral management was more important than ever. Lack of liquidity stressed organizations’ fx exposures with unexpected higher spreads and margin requirements from credit facilities. Organization who were unaware or didn’t clearly define their fx program were subject to these constraints. While there is no crystal ball to predict these events, Klarity’s depth of client experience, have shown that there are fx risk management practices that enable organizations to mitigate these risks, or responding in a swift manner, avoiding decision paralysis.

Define

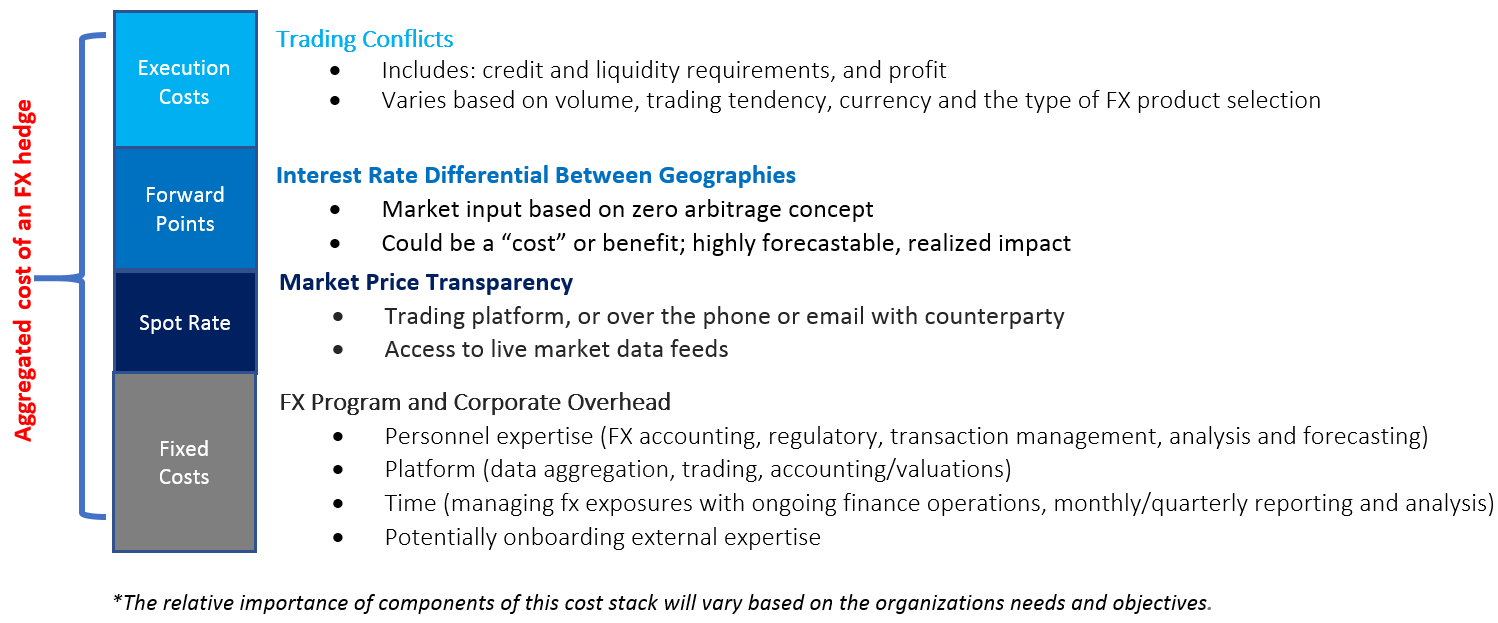

How do fx risk managers define fx hedging costs? Each multinational organization has its own unique strategy and there are many different approaches. Here’s a good template

Risk managers may look at the potential exposure’s value-at-risk – how the firm would measure the risk of a loss on a certain fx pricing portfolio on the cash flows of their non-functional currency. Only sophisticated treasury teams have the experience and resources to track these moves. Forward programs managers would analyze contract pricing and the offset from the spot rate of the hedge contract. Once this has been established, greater precision is present across organization from your sales to the board/c-suite.

Quantify

Once the program’s fx hedge cost has been clearly defined, it must be quantified. It’s important for risk managers to examine changes in macro environments. Conducting analysis on interest rate differentials in relation to the organization’s exposures will seamlessly quantify fluctuations of cost of the structured products of choice.

In a perfect world if markets didn’t move, there wouldn’t be a need to hedge at all. As volatility increases, naturally the desire and the costs of hedging follows. Carrying out a ‘value at risk’ and comparison analysis between your hedging program versus other fx strategies can bring your organization a clear advantage relative to competitors.

These routine processes will show how a well quantified program can bring better forecasting to the firm’s hedging cost while achieving greater price transparency with execution costs.

Minimize Costs

Given that most multinationals do not speculate in currency markets, the overall objective is to protect the business plan, at the most efficient cost. The treasury department should also be cautious about turning into a profit center.

The goal of a hedging program is to reduce financing costs and manage risks in the most efficient manner. While treasury departments taking on a spot program believe their avoiding risk with simplicity, they can be unnoticeably speculating thus taking on an unwarranted amount of fx risk exposure.

Having these processes being ran regularly for an organization will make the cost of hedging more effective and more transparent. This will provide the firm greater liquidity flexibility and bring greater ability to forecast the costs.

Re-Organize

Organizations do understand they must consider fx hedging programs before but accept the operations of an fx hedge as not feasible for their organization. Onboarding costs, complexity of active maintenance may dissuade a firm from implementing such a program. A firm that passively hedges can also be subject to uncertainty with their costs, by not actively reviewing their program.

Onboarding an in-house fx risk team and risk management tools to support the treasury staff could solve this, but would create a material increase on the upfront fixed costs.

Seeking out an independent advisory partner is an effective approach to receiving catered fx risk management support. It provides organizations with cost-effective access to bespoke risk management executive level expertise. This is advantageous when onboarding an in-house fx risk manager is not an option, when the organization is going through a transition between teams, or simply the primary risk manager(s) needs additional risk management support.

With a deeper understanding of the cost of currency hedging positions, organizations can achieve a strong foundation for seamless fx risk management processes.

Disclaimer: The views expressed in the article are Klarity FX's own, they should not be taken as investment advisory. Klarity FX bears no responsibility from any unforeseen outcomes that come as a result of the information in this article