Navigating FX Risk Programs as Disinflation Tilts Forward

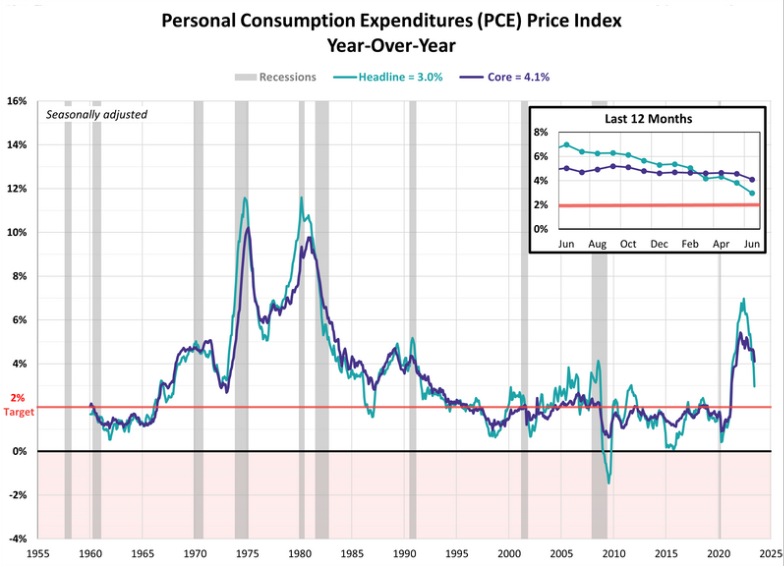

Since early 2022, central banks have taken substantial strides through interest rate hikes to address persistent inflation developments from 2020-21. Market tone is that the global economy is nearing the conclusion of the tightening cycle, especially for major central banks, signaling potential economic stabilization. Upon closer observation, a crucial question arises: "Is inflation truly reversing, and if so, in comparison to what benchmark?" Moreover, to justify cuts, inflation will need to fall towards 2%, unless a highly anticipated economic shock does not materialize. Two important considerations need to be made. One, is if we are witnessing 'disinflation', the temporary easing of prices. The second, if central bank actions going to swing the pendulum too far, taking the global economy into a rapid state of deflation.

Finance teams must assess the inflationary impact on interest rates and implement/maintain their FX risk management processes, to navigate upcoming opportunities. FX process prudence becomes even more essential for corporations compared to the decade long era of quantitative easing. The cost/benefit of hedging, purely from a forward cost perspective, has become key for hedge participants.

How FX Programs can Account for Inflation

Cost of Hedging

The landscape of hedging has significantly shifted. It's marked by an increase in forward points compared to the low interest rate era. Consequently, rolling and adjusting contracts have become more expensive. Additionally, option premium dynamics have evolved with FX volatility benchmark. They've moved higher than in previous years due to increased volumes as firms strive to manage FX price fluctuation. Moreover, higher interest rates have become a factor baked into the premiums.

Hedge Ratio Determination

Despite observing lower fx volatility in 2023, compared to spikes in 2022, currency pairs have exhibited a wider price variance. It's crucial to maintain FX hedge ratios at an agreed-upon corporate threshold. This ensures a seamless transactional P/L during customer invoicing or vendor payments. Accurate and up-to-date hedge ratios are essential to provide the capacity to both "average in" when exchange rates move favorably, or to protect against adverse currency movements.

Read More: Evolving your risk management approach

Benchmarking Performance

FX fluctuations have become more prevalent, amidst increasing interest rate variation among central banks, increasing the headache for treasury teams. It is crucial to present this information in a tailored manner that strikes a balance, avoiding unnecessary drama or vagueness. One effective approach is to provide relativity to the price performance, going beyond the annual or quarterly embedded budget rate. Benchmarking against various operational finance functions such as competitor pricing, payments or invoicing, intercompany loans, and new debt financing can help contextualize the impact of FX fluctuations on operations. It comes down to “you cannot manage what you cannot measure.”

Product Selection

A finance team's FX product decision-making is crucial for the performance of the FX hedge program. The chosen products must align with the finance team's expertise and the management team's risk tolerance. Starting with a 50% hedge ratio certainty threshold, hedging via direct Forwards meets a criterion but offers a binary outcome. However, it allows for capacity to impact the average period hedge rate in adverse market conditions while providing 50% protection against adverse rate movements.

Read More: So You've decided to hedge, but how much?

Another effective approach involves using option collar products with contingency characteristics, providing both downside protection and upside participation. Finance teams should consider the corporation's benchmark metrics that maybe aligned with payable/receivable cycles, before implementing the product. For example, a 60-day collar, covering monthly FX volume (15-25%) alongside Forwards and Spots, offers flexibility during currency volatility.

On the other hand, a higher notional and longer maturity 6–8-month strip, may achieve a more favorable rate. It may not however, be the most effective strategy, particularly for corporations following a 45-60-day payment cycle. This can leave them in a zero or hero scenario if rates move significantly.

Anticipating What's to Come

During Q2-Q3, the market has gained momentum, with speculation and front-running about the Fed potentially cutting rates in 2024. Though the situation has moderated, there have been no clear indications on rate cuts yet. It's important to consider that if there is no recession and inflation remains within target levels, the Federal Reserve (and the Bank of Canada) may not face real policy pressure to cut rates. Consequently, interest rates are likely to remain higher for longer, directly impacting corporate FX risk management processes. This can cause discrepancies in real economic activity in the corporation’s region.

It's essential for finance teams to take proactive measures in their hedging programs by establishing key processes, policies, and benchmarks to navigate the uncertainty around the disinflation story currently being projected.