Window Forwards: A Simple Tool in Uncertain Times

By Ritwik Sarkar

Jul 07, 2021

As payment uncertainties persist well into the first half of 2021, treasury teams have been evaluating flexible strategies as supply chain disruptions continue. From semiconductor backlogs to rising commodity prices due to supply side bottlenecks, the reopening still brings uncertainty. Window forwards have hence become a viable option for corporate treasurers, to combat these shortfalls.

The pandemic has brought upon greater macro uncertainty into 2021. Market conditions, have therefore led corporate boardrooms to increase their strategizing on fx hedging. We’ve seen a preference for more flexibility when it comes to their fx exposure. Our risk management team saw an increasing the use of window forwards to the hedging toolbox to manage operational uncertainties.

Window forwards are structured hedging products They allow finance teams to buy or sell a determined amount of fx within a range of settlement dates – known as windows. The contracting party can execute all or part of the contract at any point during the window, at the predetermined rate. This is so long as the full amount is traded by the settlement date.

Use Case for Window Forwards

- Importer; to control the accounts payable in one or more foreign currencies.

- Exporter; to secure the price of your foreign currency accounts receivables.

- Organization is uncertain with settlement dates with customers or vendors.

- Desire for a single exchange rate for several forward exchange transactions.

Companies use window forwards as a tool to hedge and manage fx risk. It enables them to make or receive a sequence of payments with uncertain product delivery dates, or when payment or purchase amounts are unspecified. They can also provide security by hedging profit margins with a fixed exchange rate on future payments in foreign currencies.

A Canadian firm, for example purchased goods on 30 June from a supplier in the value of EUR 600,000 ,with a delivery period of three months at a 1.2100 budgeted rate. The time the date for payment of goods is uncertain, and don't wish to be exposed to risk of exchange rate trends. On 30 June the client agrees on a forward rate with a settlement period from 26 September to 14 October, when they can purchase Euros on any business day. This gives them the protection against uncertainty in the market movements, as they’re able to time period that is best for them.

Why Add Window Forwards to Your Corporate Hedging Toolbox

During the pandemic driven uncertainty, fx managers have seen increased uncertainty in the delivery of funds. As a result, there is a greater need for a flexibility for when to pay funds.

With Canadian exporters facing stress from the Canadian Dollar strength vs the USD over the past year, fx risk management has increased as an underlying concern and broader topic of discussion across the c-suite. This hasn’t helped while day to day operation business flow has been increasingly difficult to forecast.

We spoke with Director of Finance of a marine parts distributor in Western Canada, about the use of window forwards in their ‘corporate hedging toolbox’. They pinpointed an increase in competitiveness with the ability to adjust pricing quickly, relative to their competitors, within their quarterly hedging program. Using option contracts for higher volume periods during trade shows and seasonal sales upticks. With the higher demand, this meant needing to source products from different suppliers. Window forwards became an increasingly useful tool with management, when different fx variables arose in the profile along with product

“If the US dollar shifts too widely, we have flexibility to change prices. No long windows protecting prices, keep it down to a quarterly basis so our team can adjust pricing to customer needs. Once the seasonal uptick and trade show time comes around, we look to options and window forwards especially if a different currency exposure comes about”

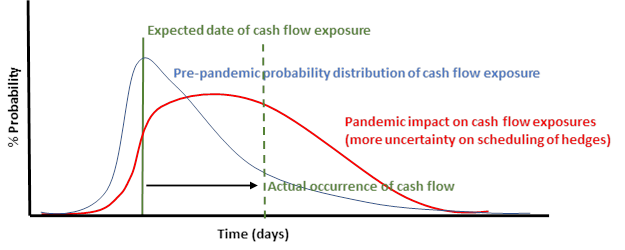

Before 2020, payment dates and receivables were easier to forecast. With record uncertainty, prevailing predictive metrics cannot be solely relied upon. Window forwards thus provide a wider band to account for them.

Implementation & Program Maintenance

A treasury team's strategy when employing window forwards, should be a calculated and measured one. We stress the need to understand the aims of their team, with their hedging program, before using complex structured products.

Rather than constantly moving money around in foreign currency accounts the simple adoption of a window forward provides greater flexibility and convenience. In a near zero interest rate environment, the cost of such flexibility is very low, making it an attractive tool.

Window Forwards aren't a One-Stop Shop

Our risk management team emphasizes there are risks that corporations must consider with the window product. In cases where the purchased currency depreciates in value, the opportunity cost is large, as the guaranteed forward exchange rate is fixed. Secondly, a window forward is a firm commitment, so it was not originally designed to cover uncertain transactions, so there must be some degree of forecast ability.

We recommend undertaking exercises such as applying a grading scale of the account’s receivables through an aging report. A useful internal practice is having the finance team communicate with sales and or logistics to provide product supply and demand forecasts to assess shipping date risk.

Relative to their competitors, companies are in a firm position with window forwards. Window forwards address the knowledge of fx commitment over a specific period. This addresses the situation of the delivery of funds with different levels of uncertainty

Conclusion

Our advisory desk has seen corporate clients respond in new calculated ways, to adjust their hedging programs and adding products. This has provided security and flexibility to their strategy.

Adding window forwards to an existing toolkit, can strengthen a company’s position against a myriad of supply-chain uncertainties. They've done so, while meeting demand of higher sales volumes and weathering foreign currency volatility. The Pandemic has helped accelerate the learning process for many fx managers.

If you'd like to discuss fx risk management strategy, you can reach us at +1 (415) 678-2808 or email us at rsarkar@klarityfx.com.

Klarity FX is not a fx bank, broker, or payments provider. We do not offer transactional products, rather we support the implementation and maintenance of corporate fx risk management profiles.