Reviewing FX Risk Programs of 2022

By Matt Dawydiak, Ritwik Sarkar

Dec 15, 2022

2022 has not ceased to let up on market participants with multiple headwinds. Corporations have shifted from treating FX and interest rate volatility as an afterthought, to active boardroom discussions. Fortune 500 companies have had to emphasize constant-currency metrics to lighten the conversation to investors.

According to the Wall Street Journal, well-run firms often have correctly identified FX program objectives, but it’s the implementation of appropriate risk footprint and hedging strategies that need to be defined, measured, and monitored to reduce margin for company error. Corporations have had difficulty coming to terms with the higher inflationary and interest rate environment. It brings a deer in the headlight’s moment with increasing FX risks around forecasts of cash delivery, all while underlying business factors have continued operating. As a best practice to avoid mistakes with or absence of benchmarking and reviewing programs, companies should regularly review their FX programs as risk profiles change during significant inflation, interest rate changes and reaction to global events.

Process Improvement

There are key areas to focus on when benchmarking and reviewing an operational FX risk management program:

Risk tolerance: Has the company's risk tolerance changed? If so, is it accounted for and how does this affect the fx risk management program? Eg; Will the firm be able to manage a worst-case scenario in FX? Has the finance staff analyzed if cash flow is optimal if delivered above or below a specific rate?

Organizational changes: Has the company undergone any significant organizational changes that might affect the risk management program? Eg; Has the firm gained or lost a new geographic exposure? Is the company issuing dividends abroad? Is new financing from abroad being assessed?

Market changes: Have there been any significant changes in the FX markets that might affect the risk management program? Eg; Has the inflation outlook plateaued and is US Dollar strength ahead of itself against other FX? Has the market structure become so volatile, that a forward program corporate hedger has to review optionality to protect the program? Has the interest rate curve changed significantly as to increase the cost of hedging materially.

New underlying business products or services: Has the company introduced any new products or services that might affect the risk management program? Eg; Has the firm started selling products or services in a new currency? Is the procurement department communicating changes in global vendors in a timely manner.

Counterparty relationship monitoring and assessment: Does the treasurer regularly review or benchmark the FX transaction counterparty? Eg; Has there been an assessment on other fx providers? Is pricing competitive? Is the relationship manager suggesting the right products or approach? Certain products work better in trending markets rather than in rangebound environments.

Strategy

Possible impact to strategy includes changes in the magnitude of FX exposures, currency structure, counterparty pricing/contract structures/relationship, heightened fx volatility, larger interest rate hikes, elevated prices, and as well organizational specific priorities.

The FX review process becomes increasingly important as this happens and adjustments to the hedging strategy is a necessary consideration on an ad-hoc basis.

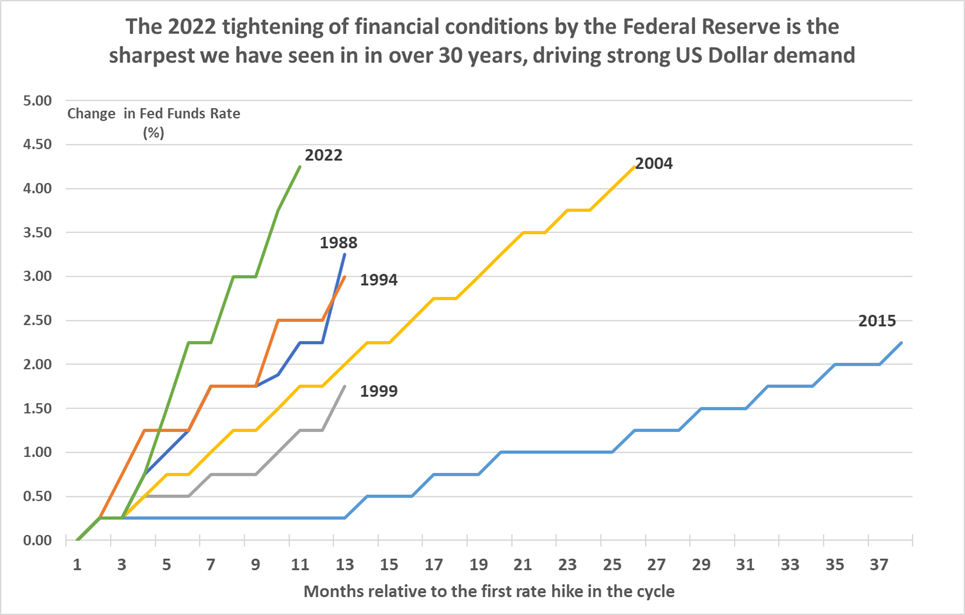

In accounting for inflationary environments, treasurers can look to the US Dollar strength as an outcome of the Federal Reserve’s aggressive tightening of financial conditions. US importers may have increased hedging parameters with FX rates reaching outlier price scenarios to bolster operational needs.

Treasury teams are typically responsible for managing exposure however, all stakeholders in the organization should have an overview of the FX risks involved, what spot rate cash is being delivered at, and the hedging structure. This helps the firm work towards a unified goal of smoothing out the company’s fx risk.

To ensure cash flow is delivered adequately and is forecastable during times of volatility, it may be best for a treasurer to follow exchange rate moving averages relative to their business cycle (Eg; 50,90,180 days). This can be a way to smooth out daily noise and mirror business transactions and invoices of the current or past period. A treasurer following these averages may analyze optimal cash flow delivery levels relative to transactions booked during the past month or quarter, and decide to layer into a hedging program on a policy % basis. This can be a straightforward way to smooth out volatility and ensure flexibility on the final cash flow delivery rate for the given period.

Model-Building Approach Communication & Implementation

There are a few common signs that it might be time for your organization to do a holistic review of its risk management practices. It’s possible the firm has experienced a change in leadership, staff shortages, going through a strategic restructure or maybe the current risk management strategy isn't working well relative to competitors.

There’s also the case that it may come down to the underlying business if affected by current external market challenges that increase volatility, prices, and interest rates. Therefore, it’s more important to periodically assess your risk management practices making sure they're still effective or can be improved.

The risk management practices are the key underlying drivers when communicating the program to stakeholders. Organizing regular FX risk meetings are an important step in staying current and communicating headwinds to ensure that the company's risk management practices remain effective and fit for purpose. Like most corporate actions pushing FX down the list of ‘to-do’ items will invariably mean when issues arise its too late to respond in an appropriate manner.

Disclaimer: The views expressed in the article are Klarity FX's own, they should not be taken as investment advisory. Klarity FX bears no responsibility from any unforeseen outcomes that come as a result of the information in this article.